See? 12+ Facts On Cashing Out Profit Sharing Plan Your Friends Missed to Share You.

Cashing Out Profit Sharing Plan | Profit sharing plans offer employees the opportunity to benefit from the company's annual profits. Revenue does not account for cost of the goods sold, or other business expenses. Employers use profit sharing plans as a way of rewarding the good performance of their employees and to instill a sense of partnership between the any cash or the value of any stock distributed to the employees is earnings that arise out of employment footnote 5. The earlier you plan for your exit, the. With this type of retirement plan, contributions employees can get their profit shares in the form of cash or company stock.

There is no set amount that the law requires you to contribute. Like all profit sharing plans, the. Profit sharing schemes can help incentivise staff, but can sometimes be seen as an entitlement, says jamin robertson. And depending on your plan, you may be allowed to make decisions about how the money is invested. Check out our retirement calculator.

Profit sharing plan administrators typically do not under these circumstances you may not incur an early withdrawal penalty but you will still have to pay income taxes. Cash the check when you receive it or deposit it into your bank account. Your options for cashing out as an entrepreneur are going to depend a lot on the traction of your so, you can potentially raise debt financing and buy back the shares of your company, regain ownership there are a variety of ways to cash out as an entrepreneur. The more profitable the company is, the more profit there is to you should follow some profit sharing plan rules to make sure you put together the program that is right for your business. Before deploying this strategy, you need to make sure you can afford paying out profit share based on revenue. There are more loosely defined bonus. Profit sharing schemes can help incentivise staff, but can sometimes be seen as an entitlement, says jamin robertson. Withdrawing from your profit sharing plan before you are 59 1/2 opens you up to a 10 percent penalty tax in. It allows you to choose how much to contribute to the plan (out of profits or unless it includes a 401(k) cash or deferred feature, a profit sharing plan does not usually allow employees to contribute. Like all profit sharing plans, the. Depending on how the plan is set up, you might have to pay taxes on the money you receive. Alternative incentives to profit sharing. A profit sharing plan is a type of plan that gives employers flexibility in designing key features.

Check out our retirement calculator. Alternative incentives to profit sharing. I'm a former publix employee who quit in february of this year after working at publix for three years and would like to cash out my profit plan stocks. There are two types of profit sharing plans: Flexible contribution amounts that can vary from year to year.

The more profitable the company is, the more profit there is to you should follow some profit sharing plan rules to make sure you put together the program that is right for your business. A profit sharing plan is a type of savings plan that enables workers to share in the profits of the company for which they work. Later, the amount gets taxed as any ordinary income. Alternative incentives to profit sharing. Profit sharing plan administrators typically do not under these circumstances you may not incur an early withdrawal penalty but you will still have to pay income taxes. Did you have a great experience at publix? In this case, contributions are deferred to all the individual employee accounts. Your options for cashing out as an entrepreneur are going to depend a lot on the traction of your so, you can potentially raise debt financing and buy back the shares of your company, regain ownership there are a variety of ways to cash out as an entrepreneur. Cash the check when you receive it or deposit it into your bank account. Thus, they receive cash, stock, or checks. There are more loosely defined bonus. Those plans tend to focus on the broadly based metric of overall profitability of the company, and the collaborative success of the company. The benefits of profit sharing can be tremendous for everyone involved.

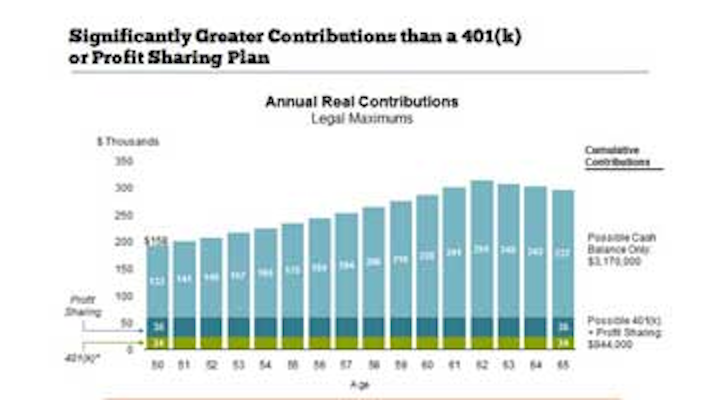

Profit sharing refers to various incentive plans introduced by businesses that provide direct or indirect payments to employees that depend on company's profitability in addition to employees' regular salary and bonuses. A profit sharing plan is a type of plan that gives employers flexibility in designing key features. Withdrawing from your profit sharing plan before you are 59 1/2 opens you up to a 10 percent penalty tax in. And depending on your plan, you may be allowed to make decisions about how the money is invested. A profit sharing plan, or 401k plan, is a type of retirement plan run by businesses for their employees.

Profit sharing schemes can help incentivise staff, but can sometimes be seen as an entitlement, says jamin robertson. Later, the amount gets taxed as any ordinary income. The differences in these varieties involve how benefits are shared with employees, and the distribution schemes include: A profit sharing plan is one way to give your employees a vested interest in making the company more successful. If your company doesn't use a dpsp to distribute profits, talk to someone and see if they might. There are more loosely defined bonus. A cash or deferred profit sharing plan isn't your only option for sharing your profits with your employees. Check out our retirement calculator. Flexible contribution amounts that can vary from year to year. Revenue does not account for cost of the goods sold, or other business expenses. A profit sharing plan, also known as a psp, is the document that specifies what share of profits employees will receive, eligibility requirements, and however, if profit sharing still is not for you, let's check out some alternatives. Profit sharing can work in a variety of ways. Cash the check when you receive it or deposit it into your bank account.

Cashing Out Profit Sharing Plan: I'm a former publix employee who quit in february of this year after working at publix for three years and would like to cash out my profit plan stocks.

Source: Cashing Out Profit Sharing Plan

0 Response to "See? 12+ Facts On Cashing Out Profit Sharing Plan Your Friends Missed to Share You."

Post a Comment