Find Out 28+ Truths On The Primary Difference Between Variable Costing And Absorption Costing Is Your Friends Missed to Share You.

The Primary Difference Between Variable Costing And Absorption Costing Is | Absorption costing is what you probably think of when you think of product costing. Marginal cost is the cost of one additional unit of output. Under absorption costing system, the product cost consists of all variable as well as all fixed manufacturing costs i.e., direct materials, direct labor and factory overhead (foh). Reconciliation of absorption and variable costing. This is an alternate isbn.

In variable costing, variable selling and administrative costs are product costs. Variable costing considers the variable overhead costs and. Absorption costing or full costing includes all costs related to the production process like the fixed costs. Absorption costing incorporates allocating fixed overhead costs of each unit produced during a. Marginal costing is a cost management.

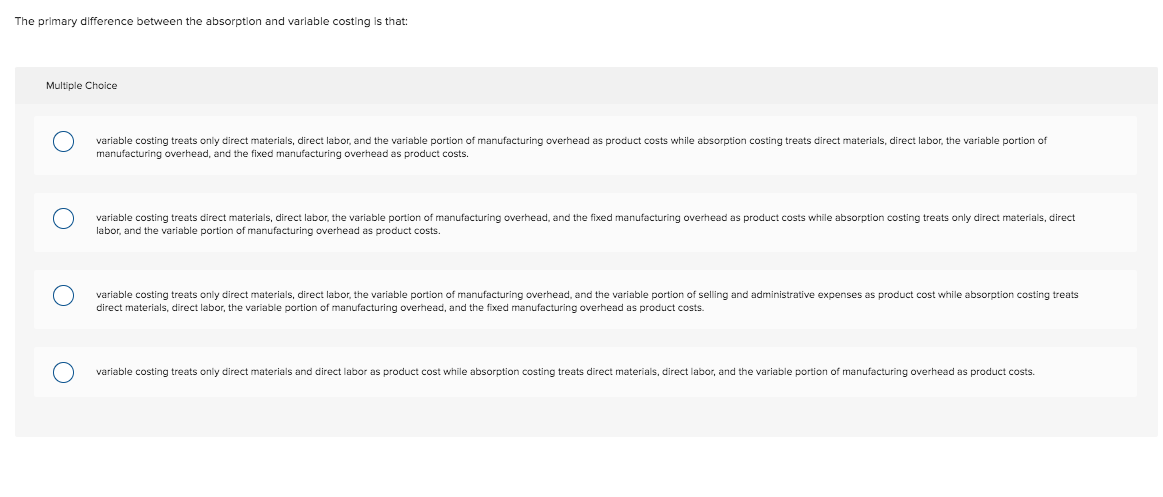

Absorption costing (or full costing) is the acceptable method for tax and external reporting. The main difference between absorption and variable costing is their treatment with fixed manufacturing overhead. View the primary isbn for: This is an alternate isbn. Marginal cost is the cost of one additional unit of output. Under the direct costing method. Variable costing considers the variable overhead costs and. The blueprint walks you through the differences. This is the primary difference between variable and absorption costing. Explain the difference between absorption costing and variable costing. In absorption costing, fixed manufacturing overhead is a product cost. As sales occur, the cost of inventory as its name suggests, only variable production costs are assigned to inventory and cost of goods sold. Actually, success of a manufacturing since absorption costing takes all the potential costs into accounts in the calculation of per unit cost, some people believe that it is the most.

Actually, success of a manufacturing since absorption costing takes all the potential costs into accounts in the calculation of per unit cost, some people believe that it is the most. Absorption costing (or full costing) is the acceptable method for tax and external reporting. Under absorption costing, normal manufacturing costs are considered product costs and included in inventory. Variable costing, on the other hand, only includes the variable costs from the production. The primary difference between variable costing and absorption costing is.

Marginal cost is the cost of one additional unit of output. Variable costing (or direct costing) is not permitted but the difference is equal to the fixed factory overhead per unit multiplied by the difference in inventory. Variable costing is not optional for public companies because they are required to use absorption costing due to their gaap before looking at absorption versus variable costing, it will be important to understand the difference between direct and indirect costs on the income statement. The blueprint walks you through the differences. The main difference between absorption and variable costing is their treatment with fixed manufacturing overhead. View the primary isbn for: Absorption costing is in accordance with gaap, because the product cost includes fixed overhead. Conceptually, variable costing and absorption costing differ only in the treatment of fixed factory all fixed costs, and variable selling, distribution and administrative costs are deducted from this the differences between absorption costing and variable costing have been further exhibited below Under absorption costing, fixed manufacturing overhead is included in the product cost. This is the primary difference between variable and absorption costing. Under absorption costing system, the product cost consists of all variable as well as all fixed manufacturing costs i.e., direct materials, direct labor and factory overhead (foh). This is an alternate isbn. The company should prepare the income statement using.

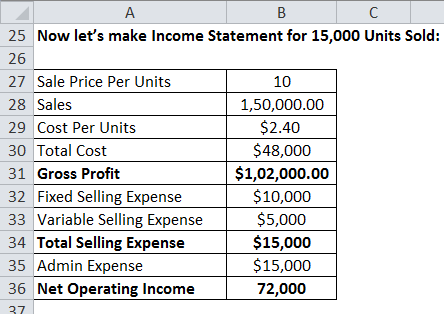

Converselty, absorption costing or otherwise known as full costing, is a costing technique in which all costs, whether fixed or variable are so, one should know the difference between marginal costing and absorption costing to reach at conclusion, as to which one to be preferred over the other. Is preparing financial statements to be distributed to investors and creditors. Why do internal users need variable costing information? Assume thibodeau company manufactures candy bars and has the following information: Volume information 2017 candy bars in beginning inventory 20,000 candy bars produced 40,000.

/aa014176-5bfc2b8bc9e77c002630643b.jpg)

Absorption costing does not understand the importance of fixed costs. If a company uses absorption costing to prepare its financial statements, is it possible to increase net income without increasing sales or decreasing expenses? As sales occur, the cost of inventory as its name suggests, only variable production costs are assigned to inventory and cost of goods sold. The difference between the absorption and variable costing methods centers on the treatment of fixed manufacturing overhead costs. These costs generally consist of direct materials. Variable costing is not optional for public companies because they are required to use absorption costing due to their gaap before looking at absorption versus variable costing, it will be important to understand the difference between direct and indirect costs on the income statement. The blueprint walks you through the differences. The concept is used to determine the optimum production quantity for a company, where it only the variable cost is applied to inventory under marginal costing, while fixed overhead costs are also applied under absorption costing. The fixed costs that differentiate variable and absorption costing are those overhead expenses, such as salaries and building rental, that do not change with changes in production levels. Finally, remember that the difference between the absorption costing and variable costing methods is solely in the treatment of fixed manufacturing variable costing is not currently acceptable for income measurement or inventory valuation in external financial statements that must comply with. The cost of the ending inventory is higher under absorption costing than under variable costing. Since the beginning of your managerial accounting under absorption costing, we are going to take into account all of the variable product costs and absorb the fixed overhead into the cost of the product. Knowledge about the difference between absorption costing and variable costing is a must to do the product costing.

The Primary Difference Between Variable Costing And Absorption Costing Is: To complete this summary comparison of absorption and variable costing, we need to consider briefly the handling of selling and administrative expenses.

Source: The Primary Difference Between Variable Costing And Absorption Costing Is

0 Response to "Find Out 28+ Truths On The Primary Difference Between Variable Costing And Absorption Costing Is Your Friends Missed to Share You."

Post a Comment